When a currency devalues, it directly erodes your wealth and purchasing power, forcing difficult choices about allocating limited resources and potentially sacrificing essential expenses or discretionary spending. Devaluation leads to a loss of monetary freedom, undermining economic stability. Your savings and investments decrease in value, and the real wage value decreases, affecting your purchasing power. Debt repayment terms may ease, but foreign debt obligations become more burdensome. As you navigate the complexities of currency devaluation, understanding its far-reaching implications on your financial security and wealth is vital - and there's more to explore on this critical topic.

Key Takeaways

- Currency devaluation directly affects purchasing power, diminishing wealth and reducing the ability to afford goods and services.

- Devaluation erodes financial security, making it harder to achieve long-term financial goals and forcing difficult choices about allocating limited resources.

- Debasement can substantially reduce wealth and limit financial freedom, as the value of money dwindles and real wage value decreases.

- A devalued currency can lead to increased export opportunities, but also increases the cost of living, requiring more money to maintain the current standard of living.

- Devaluation can ease domestic debt repayment terms, but makes foreign debt obligations increasingly burdensome, affecting wealth and financial stability.

Devaluation Reduces Wealth Power

When a currency is debased, its reduced value directly affects your purchasing power, diminishing your wealth and reducing your ability to afford the same goods and services.

This loss of monetary freedom undermines your economic stability, as the value of your money dwindles.

As a result, you may struggle to maintain your standard of living, and economic inequality may widen.

The devaluation of currency erodes your financial security, making it harder to achieve long-term financial goals.

With reduced purchasing power, you may need to make difficult choices about how to allocate your limited resources, potentially sacrificing essential expenses or discretionary spending.

Ultimately, debasement can substantially reduce your wealth and limit your financial freedom.

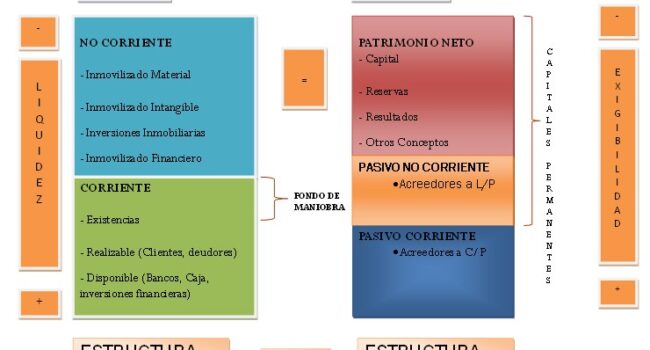

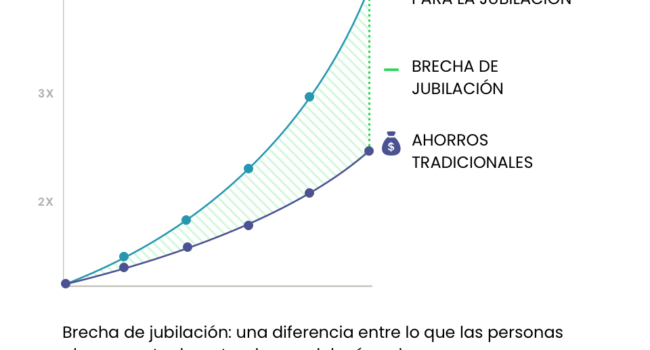

Effects on Savings and Investments

As you consider the effects of currency devaluation on your financial situation, you'll notice that the value of your investments will likely decline.

The purchasing power of your savings will erode over time.

This means that the money you've set aside for the future will be able to buy fewer goods and services than it could before the devaluation.

You'll need to adjust your financial plans to account for these changes and guarantee that your savings and investments continue to work in your favor.

Investment Value Declines

Your savings and investments take a hit as the value of your money declines with debasement, leaving you with less purchasing power and a dwindling nest egg.

As a result, your investment portfolio's value declines, reducing your wealth.

A well-diversified asset allocation strategy can help mitigate some of the losses, but you must reassess your investments in this new economic landscape.

Market volatility increases, making it challenging to predict returns.

You may need to rebalance your portfolio to adjust to the changing market conditions.

Consider consulting a financial advisor to help you navigate these uncertain times.

Savings Erosion Over Time

Over time, debasement silently erodes the purchasing power of your savings, gradually reducing the value of your hard-earned money.

As the value of your savings dwindles, your financial legacy is threatened. You worked hard to build a timeless wealth, but debasement can render it worthless.

Your savings, once meant to secure your future, are now vulnerable to the erosive effects of debasement.

It's vital to understand that debasement is a silent thief, stealing the value of your money without you even realizing it.

To protect your financial legacy, being aware of the impact of debasement on your savings and taking proactive steps to preserve your wealth is imperative.

Inflation Spurs as a Direct Impact

As you explore the direct impact of currency devaluation, you'll notice that inflation spurs are a significant consequence.

When a currency loses value, the prices of goods and services increase, and your purchasing power takes a hit.

You'll see that the cost of living increases, and you'll need more money to maintain your current standard of living.

Purchasing Power Deteriorates

One direct impact of currency devaluation is that your purchasing power deteriorates, as the same amount of money can now buy fewer goods and services due to the increased prices resulting from inflation.

This erosion of purchasing power directly affects your monetary freedom, limiting your ability to afford the necessities and luxuries you once enjoyed.

Your financial security is also compromised, as the value of your savings dwindles.

The decreased purchasing power means you must spend more to maintain your current standard of living, reducing your financial flexibility.

As a result, you may need to make difficult financial decisions, such as cutting back on discretionary spending or reducing your savings rate, to cope with the reduced purchasing power.

Cost of Living Increases

When currency devaluation leads to inflation, you're likely to notice a sharp increase in your living expenses, as the prices of everyday items, services, and necessities start to surge.

This means you'll have to spend more to maintain your current standard of living, which can be particularly challenging if your income doesn't keep pace with inflation.

Economic uncertainty and financial instability can exacerbate the situation, making it difficult to budget and plan for the future.

As a result, you may need to make lifestyle adjustments, such as cutting back on discretionary spending or finding ways to reduce essential expenses.

You must be proactive in managing your finances during periods of high inflation to minimize the impact on your wealth.

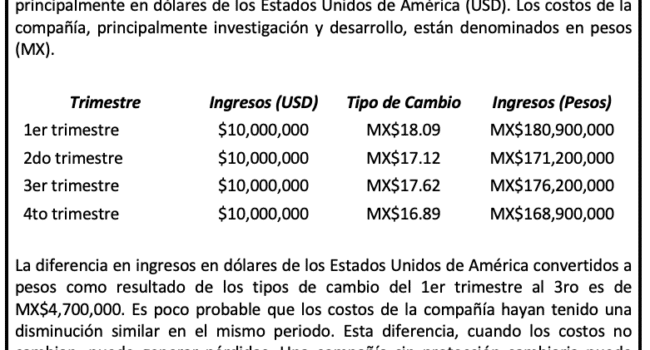

International Trade Dynamics Change

As you explore the impact of currency devaluation on international trade dynamics, you'll notice that export opportunities rise, while import costs soar.

This shift can be attributed to the devalued currency making domestic products more competitive in the global market, leading to an increase in exports.

On the other hand, the increased cost of imports can lead to higher production costs for domestic companies that rely on imported goods and services.

Export Opportunities Rise

Devaluation of a currency can lead to a surge in export opportunities, making your products more competitive in the global market.

As a result, you can take advantage of new trade agreements and economic zones to expand your business.

With a devalued currency, your exports become cheaper for foreign buyers, increasing demand and potentially leading to higher sales.

This is particularly beneficial if you operate in industries with high export potential, such as manufacturing or agriculture.

By capitalizing on these opportunities, you can boost your revenue and gain a competitive edge in the global market.

With the right strategy, a devalued currency can be a blessing in disguise for your business.

Import Costs Soar

Your import costs skyrocket as a devalued currency makes foreign goods and services more expensive, putting pressure on your profit margins and potentially disrupting your supply chain.

This increase in costs can be devastating to your business, especially if you rely heavily on imports.

Renegotiate trade agreements: Review your contracts and negotiate new terms with your suppliers to mitigate the effects of the devaluation.

Diversify your supply chain: Consider alternative suppliers or sourcing options to reduce your reliance on imports.

Hedging strategies: Explore currency hedging strategies to manage exchange rate risks.

Review pricing strategies: Adjust your pricing to reflect the increased costs, but beware of the potential impact on demand.

Impact on Debt and Loans

As you examine the impact of currency devaluation on debt and loans, you'll find that the effects are two-fold.

On the one hand, you'll benefit from eased repayment terms on domestic debt, as the devalued currency makes your loan payments relatively smaller.

On the other hand, foreign debt obligations will become increasingly burdensome, as the devalued currency means you'll need more of it to service those debts.

Domestic Debt Repayment Eases

When a government debases its currency, it can repay its domestic debt more easily, since the value of the debt decreases over time due to inflation. This means you, as a citizen, will be repaying debts with cheaper dollars, effectively reducing the burden.

Fiscal Flexibility: Governments gain more freedom to allocate resources, as debt repayment becomes less burdensome.

Debt Consolidation: Domestic debt can be consolidated, allowing for more efficient management.

Reduced Interest Payments: With lower debt values, interest payments also decrease, freeing up more funds for other uses.

Economic Stimulus: The increased fiscal flexibility can lead to more government spending, stimulating economic growth.

Foreign Debt Burden Grows

Debasing a currency can have a devastating impact on foreign debt, causing the burden to balloon as the value of the currency plummets.

You'll face a significant increase in the amount of money you owe, making it even harder to pay back loans. This can lead to debt restructuring, where you'll need to renegotiate the terms of your loan with creditors.

Sovereign risk, or the risk of a country defaulting on its debt, also increases, making it more challenging to secure new loans in the future.

As the value of your currency drops, the value of your foreign debt increases, putting a strain on your economy.

You must have a solid plan in place to manage your foreign debt and mitigate the risks associated with currency devaluation.

Wage Value and Employment Effects

As you explore the effects of currency devaluation, you'll notice that the real wage value decreases, affecting your purchasing power.

This, in turn, leads to changes in employment patterns, as businesses adjust to the new economic landscape.

You'll see shifts in the job market, as some industries thrive while others struggle to stay afloat.

Real Wage Value Decreases

As currency devaluation leads to inflation, your real wage value takes a hit, and you're left with less purchasing power. Your money doesn't go as far as it used to, and you're forced to make adjustments to your lifestyle. This decrease in real wage value can lead to a significant impact on your overall wealth.

Lost purchasing power: Your money is worth less, and you can't afford the same goods and services as before.

Wealth disparity: The wealthy tend to hold assets that increase in value during inflation, widening the wealth gap.

Reduced savings: Inflation erodes the value of your savings over time, making it harder to achieve long-term financial goals.

Decreased standard of living: As your real wage value decreases, you may need to make sacrifices to maintain your standard of living.

Understanding these effects can help you make informed decisions to protect your financial well-being.

Employment Patterns Shift

When your real wage value takes a hit due to currency devaluation, you're not only affected financially, but also professionally, as employers respond to the changed economic landscape by adjusting their hiring practices and workforce management strategies.

As a result, you may face Job Security Concerns, as companies reassess their staffing needs and adjust their workforce accordingly.

This shift in employment patterns can lead to Industry Evolution, as businesses adapt to the new economic reality.

You may need to develop new skills or consider alternative career paths to stay competitive in a changing job market.

Staying informed about the impact of currency devaluation on employment patterns can help you navigate these changes and make informed decisions about your professional future.

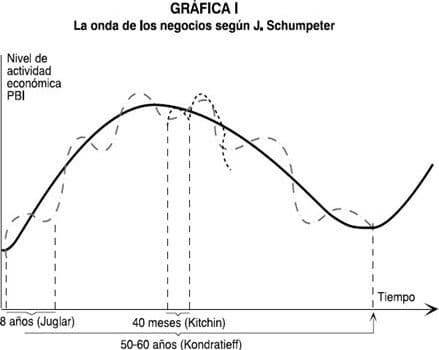

Long-term Economic Growth Potential

As you explore the long-term economic growth potential of a devalued currency, you'll find that it can either boost your country's competitiveness in the global market or lead to stagnation and recession.

A devalued currency can make exports cheaper and more attractive to foreign buyers, potentially increasing demand and stimulating economic growth.

However, a devalued currency can also lead to higher production costs, reduced consumer purchasing power, and decreased economic growth.

Potential for Increased Competitiveness

Devaluation can potentially lead to increased competitiveness in the long run, particularly if a country's exports become cheaper and more attractive to foreign buyers. This can lead to an increase in exports, which can boost economic growth.

You'll need to adapt to the new market conditions and find ways to stay competitive.

Improve market flexibility: Be prepared to adjust your production and pricing strategies to respond to changes in demand.

Invest in economic reform: Implement policies that promote economic growth, such as reducing bureaucracy and increasing investment in infrastructure.

Increase efficiency: Streamline your production processes to reduce costs and improve productivity.

Diversify your exports: Explore new markets and products to reduce dependence on a single market or product.

Risks of Stagnation and Recession

A devalued currency can have a darker side, as it can lead to stagnation and recession if not managed properly, ultimately hindering long-term economic growth potential.

As a result, you'll face an increased risk of economic downturn, where your economy experiences a decline in growth, leading to reduced economic activity.

This, in turn, can lead to market instability, where investors become uncertain about the future, causing a decline in investment and consumption.

If not addressed, this can lead to a vicious cycle of stagnation, making it difficult for your economy to recover.

To avoid falling into this trap, policymakers must implement measures that promote economic stability and growth, thereby preventing stagnation.

Frequently Asked Questions

What Happens to Cash Reserves During Debasement?

When debasement occurs, you'll see your cash reserves dwindle as inflation rises, causing reserve erosion - the value of your money decreases, and purchasing power dwindles, leaving you with less buying power.

Can Debasement Lead to Economic Growth in the Short Term?

You might think debasement can stimulate economic growth in the short term through fiscal stimulus and monetary policy, as increased money supply can boost spending and investment, but beware of long-term inflationary consequences.

How Does Debasement Affect the Value of Fixed Assets?

As you invest in fixed assets, debasement can actually boost their value through property appreciation, but beware of asset inflation, where the increased value is only nominal and doesn't reflect real growth.

Can Individuals Protect Themselves From Debasement Consequences?

You can shield yourself from debasement's negative effects by diversifying your portfolios and making smart investing decisions, spreading your wealth across assets that historically perform well during inflationary periods, protecting your purchasing power.

Is Debasement a Sustainable Long-Term Economic Strategy?

You might think debasement is a quick fix, but it's not a sustainable long-term strategy, as Central Banks' lack of fiscal discipline leads to inflation, eroding citizens' purchasing power and ultimately, economic instability.

Conclusion

To protect your wealth from the effects of currency devaluation, diversifying your investments is crucial.

Prioritizing debt reduction is also essential, as it reduces your reliance on borrowed money and minimizes the impact of inflation.

Maintaining an emergency fund is vital, as it provides a safety net during times of economic uncertainty.

Stay informed about economic trends and adjust your financial strategy accordingly.

By understanding the implications of debasement, you can make informed decisions to safeguard your wealth and purchasing power.

Si quieres conocer otros artículos parecidos a Impacto De La Devaluación De La Moneda En La Riqueza puedes visitar la categoría Inversión.

También te puede interesar: